Understanding the real cost behind a cup of coffee is essential for anyone interested in the global industry, especially when discussing Brazilian coffee. As the world’s largest producer, Brazil shapes global prices, influences supply chains, and sets quality standards. Because this agricultural powerhouse faces economic, climatic, and logistical challenges, analyzing production costs helps reveal where value is created — and where risks remain. Through this perspective, Brazilian coffee becomes not only an agricultural staple but also a key element of the coffee economy and global market stability.

Brazil’s Coffee Landscape

Brazil stands out in the global coffee sector due to its vast production regions, technological advancements, and diverse farming structures. Since each region contributes differently to yield and quality, Brazilian coffee carries unique production challenges influenced by geography, altitude, and climate. While Brazil cultivates both Arabica and Robusta (Conilon), Arabica dominates export markets thanks to its flavor complexity and premium value. Additionally, the country hosts nearly 300,000 coffee farms, ranging from small family plots to highly mechanized operations, all shaping the Brazil coffee supply chain.

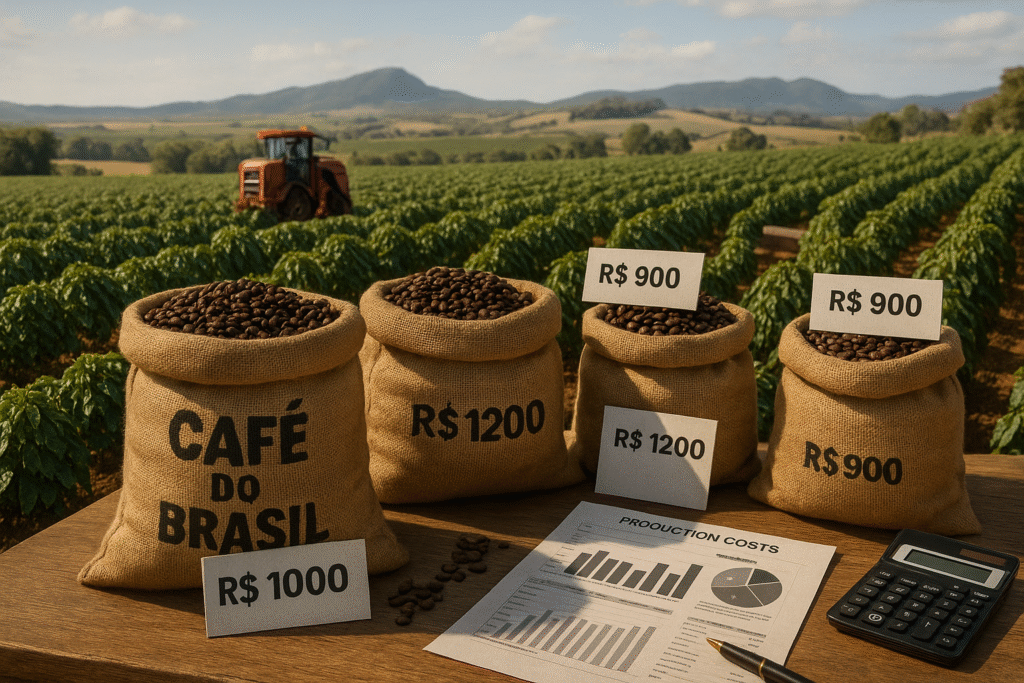

Average Production Costs per Bag

Production costs vary widely depending on climate, farm size, elevation, and the type of coffee grown. Still, most research institutions estimate that producing a standard 60 kg bag of Arabica in Brazil costs between R$ 900 and R$ 1,200. Because mechanization is more common in flat regions, some areas achieve lower costs, but mountainous zones rely heavily on manual labor. Consequently, Brazilian coffee often reflects regional disparities that directly affect final pricing. Meanwhile, Robusta (Conilon), which thrives in warmer climates and lower altitudes, typically costs between R$ 600 and R$ 800 per bag. These averages exclude transportation, taxes, and export-related expenses, making the full cost of coffee considerably higher for international buyers.

Major Cost Components in Coffee Production

Labor: The Most Significant Expense

Labor remains one of the largest cost factors in Brazil’s coffee sector, especially during harvest season. Since many mountain regions are unsuitable for machines, hand-picking remains essential for quality and precision. Because of this dependency, Brazilian coffee production requires significant investment in wages, training, and compliance with federal labor laws. Yet, even highly mechanized farms must maintain skilled operators for equipment, illustrating how labor continues to shape the Brazil coffee industry.

Inputs: Fertilizers, Pesticides, and Seedlings

Fertilizers represent a large share of the input budget, and their prices fluctuate based on global supply. These swings have become particularly severe during recent geopolitical crises, impacting the stability of the coffee economy. Since diseases like coffee leaf rust pose serious threats, producers use pesticides and fungicides regularly to protect their plantations. As farmers adapt to climate shifts, demand for resilient seedlings increases, pushing producers to invest in high-quality plant varieties. Because of these combined pressures, input costs substantially raise the price of Brazilian coffee.

Machinery and Maintenance

Mechanization improves efficiency and reduces long-term labor dependency. However, investment in harvesters, tractors, irrigation systems, and drying equipment is high. As farms scale up, so do fuel and maintenance requirements, creating a complex infrastructure cost structure. Because technology supports productivity and consistency, these expenses form an essential part of the modern coffee value chain. Consequently, even advanced farms must balance innovation with financial sustainability to remain competitive.

Infrastructure and Land Expenses

Land prices vary dramatically across Brazil’s producing regions, affecting long-term capital costs. Storage facilities, drying patios, mechanical dryers, and water systems are also necessary to maintain quality standards. Since many small farmers lack such infrastructure, cooperatives play a crucial role in supporting Brazilian coffee production at affordable rates. Through shared technology and logistics, cooperatives strengthen the coffee economy and open opportunities for producers who otherwise could not afford the necessary resources.

Regulatory and Administrative Costs

Certifications such as Organic, Fair Trade, and Rainforest Alliance create access to premium markets but require fees, inspections, and compliance audits. Taxes, insurance, and documentation for exports also add to the total cost. Because international buyers increasingly demand transparency, administrative costs have become a fundamental part of exporting Brazilian coffee, especially for specialty markets.

External Pressures: Climate and Market Volatility

Climate instability remains one of the biggest challenges for coffee production. Frosts, droughts, and irregular rainfall cycles directly affect yield and quality. Since these events reduce output, the cost per bag increases — even when farmers produce less. Meanwhile, global price fluctuations influenced by currency shifts, supply chains, and speculative markets create additional uncertainty. Because Brazilian coffee plays such a dominant role in global supply, climate impacts in Brazil often ripple across the entire coffee economy, affecting prices worldwide.

When the Selling Price Is Lower Than Production Cost

During periods of low international prices, many producers — especially smallholders — sell below production cost. Since this is unsustainable, farmers turn to specialty markets, direct trade, and differentiated quality strategies to secure better prices. Consequently, Brazilian coffee increasingly targets value-added markets where buyers prioritize transparency, origin, and farm-level sustainability. Through this shift, the Brazil coffee sector strengthens its position and reduces vulnerability to commodity market swings.

How Farmers Reduce and Manage Production Costs

Producers employ several strategies to remain profitable despite volatility. Cooperatives allow shared equipment, processing infrastructure, and marketing support, reducing the financial burden for small farms. Mechanization boosts efficiency in regions suited for machinery, especially in Cerrado Mineiro. Many farmers diversify crops — such as bananas or maize — to secure extra income during poor coffee years. Because input prices fluctuate, sustainable farming methods help reduce reliance on chemical fertilizers and protect long-term yields. These strategies make the Brazilian coffee sector more adaptable and resilient within the global coffee economy.

Final Thoughts: Understanding the Real Value of Coffee

Recognizing the cost behind Brazilian coffee reveals how dedication, risk, and expertise shape every cup. While Brazil remains a global leader, its farmers face rising production costs driven by climate, market forces, and operational challenges. Still, innovation, sustainability, and cooperative models continue to strengthen the country’s position in the coffee world. Appreciating these realities not only deepens our understanding of coffee but also highlights the importance of supporting responsible, fair, and sustainable production.